Quadra Capital annonce un partenariat avec Carmignac, un gestionnaire d’actifs européen de premier plan

Montréal, le 26 octobre 2022 – Quadra Capital Partners (« Quadra »), en collaboration avec le Groupe Walter, annonce un partenariat exclusif avec Carmignac, une société de gestion d’actifs indépendante européenne multirécompensée pour la qualité de sa gestion. Quadra devient ainsi, pour le long terme, le distributeur de la gamme de fonds Carmignac auprès des investisseurs canadiens.

Carmignac propose plus de vingt stratégies gérées activement dans les principales classes d’actifs : les actions, le revenu fixe, les stratégies alternatives et la gestion diversifiée. Carmignac est reconnue pour sa gestion de conviction sur les marchés mondiaux, émergents et européens, combinant une solide vue macroéconomique, l’analyse de données ascendante et la prise en compte des critères environnementaux, sociaux et de gouvernance. Créée en 1989, Carmignac se distingue dans l’industrie européenne de la gestion d’actifs par un fort esprit entrepreneurial.

« Quadra a hâte d’offrir aux investisseurs canadiens la possibilité d’accéder à la gestion de conviction de Carmignac et à son approche de l’investissement durable, se réjouit Guillaume Touze, fondateur et chef de la direction, Quadra Capital Partners. Nous mettrons à profit notre présence au Canada et travaillerons étroitement avec Gestion d’actifs mondiale Walter, notre partenaire et actionnaire, pour commercialiser activement les fonds Carmignac. »

« Nous sommes ravis de nous associer à Quadra au Canada. Son équipe montréalaise jouera un rôle essentiel dans la promotion de notre marque dans le pays, explique Eric Helderlé, cofondateur et directeur général de Carmignac Gestion Luxembourg. Nous avons à cœur de soutenir les efforts de Quadra avec la venue régulière au Canada de nos principaux décideurs. »

À propos de Quadra Capital Partners

Quadra Capital Partners est une société indépendante de gestion d’actifs spécialisée dans des stratégies d’investissements alternatifs avec des bureaux à Montréal, Londres, Paris et Madrid. Quadra Capital a pour principal objectif d’offrir à ses investisseurs un ensemble de stratégies innovantes et non-corrélées gérées par des gestionnaires de portefeuilles expérimentés dans des fonds internes ou par le biais de partenariats stratégiques. www.quadra-capital.com

À propos de Carmignac

Carmignac est une société de gestion d’actifs financiers indépendante fondée en 1989 sur trois principes fondamentaux toujours d’actualité : un esprit entrepreneurial, la perspicacité humaine et un engagement actif. La société a toujours gardé ce même esprit entrepreneurial, qui donne à son équipe de gestion la liberté et le courage de réaliser ses propres analyses de risques, de les traduire en de solides convictions, puis de les mettre en œuvre. Sa culture collaborative axée sur la discussion, le travail de terrain et la recherche en interne signifie qu’elle renforcera toujours ses analyses de données par la perspicacité humaine pour mieux gérer la complexité et évaluer les risques cachés. Son équipe est composée de gestionnaires actifs et de partenaires engagés auprès de ses clients. Transparente quant à ses décisions d’investissement, la société assume toujours ses responsabilités. Avec un capital entièrement détenu par la famille et les collaborateurs, Carmignac est aujourd’hui l’un des leaders européens de la gestion d’actifs et opère depuis sept bureaux différents. Aujourd’hui, et depuis toujours, elle s’engage à donner le meilleur d’elle-même pour gérer activement l’épargne de ses clients sur le long terme. www.carmignac.lu

À propos de Groupe Walter

Issu d’une entreprise multigénérationnelle du domaine industriel qui est devenue un chef de file de son secteur, le Groupe Walter a évolué pour s’établir depuis plus de 10 ans comme une firme d’investissement composée de 35 professionnels aguerris. Appuyée par des valeurs familiales, la firme adopte une approche entrepreneuriale de la gestion d’actifs dans les marchés publics, les placements privés et les stratégies alternatives, pour des clients internes et externes, à travers ses cinq unités d’investissements spécialisées et ses firmes partenaires. www.groupewalter.ca

À propos de Gestion d’actifs mondiale Walter

Lancée en 2018, Gestion d’actifs mondiale Walter est une plateforme d’investissements privés mondialement diversifiés qui offre du capital de développement et une expertise stratégique à des firmes de gestion d’actifs exceptionnelles, de même qu’à des distributeurs et à des fournisseurs de services de cette industrie, selon une approche basée sur un réel partenariat. Gestion d’actifs mondiale Walter fait partie de l’écosystème du Groupe Walter, qui prospère depuis près de 70 ans. www.walter-gam.com

Pour information – médias :

Amélie Plante

DDMG Communications

+1-514-975-9425

Pour information – investisseurs :

Sebastien Gangnat-Tunzini

Quadra Capital Partners

+1-438-884-9238

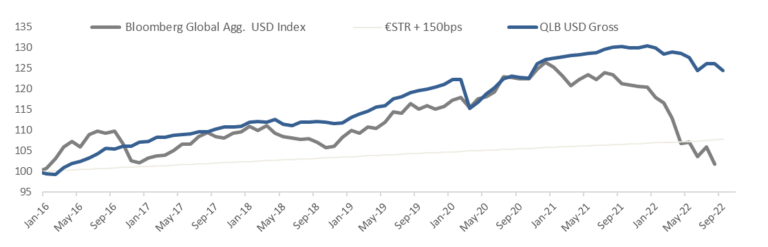

Source Apex / Quadra Capital Partners / Bloomberg. As at 30/09/2022. Blend simulated performance calculated with the allocation as of 31/12/2021. Live performance since April 2021. Past performance is not a reliable indicator of future results and investors may not get back amount originally invested. Ref index; €STR + 150bps.

Source Apex / Quadra Capital Partners / Bloomberg. As at 30/09/2022. Blend simulated performance calculated with the allocation as of 31/12/2021. Live performance since April 2021. Past performance is not a reliable indicator of future results and investors may not get back amount originally invested. Ref index; €STR + 150bps.

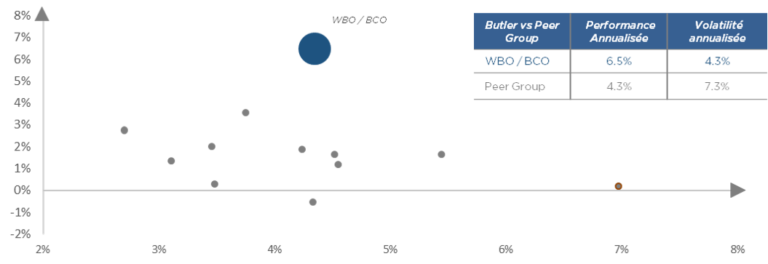

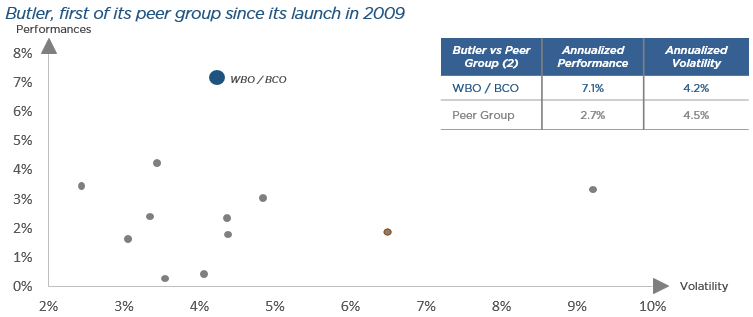

Source Butler Investment Manafers and Bloomberg as of 30/09/2022. The performance of WBO/BCO os represented by the USD A2 share class of the WBO fund since inception on the 01/10/2009 till 31/05/2017, then by the EUR Institutional Founder (ISIN; IE00BMVX1R57) of the BCO fund from 01/06/2017 till as of date. BCO Investments present a risk of loss of capital and their liquidity may be limited. Income is not garanteed and depends on the evolution of te financial markets and/or exchange rates. These performance figures to the past and past performance is not a reliable guide to the future performance. Since WBO inception 01/10/2009.

Source Butler Investment Manafers and Bloomberg as of 30/09/2022. The performance of WBO/BCO os represented by the USD A2 share class of the WBO fund since inception on the 01/10/2009 till 31/05/2017, then by the EUR Institutional Founder (ISIN; IE00BMVX1R57) of the BCO fund from 01/06/2017 till as of date. BCO Investments present a risk of loss of capital and their liquidity may be limited. Income is not garanteed and depends on the evolution of te financial markets and/or exchange rates. These performance figures to the past and past performance is not a reliable guide to the future performance. Since WBO inception 01/10/2009.

FLEXAM TAIF II has supported the expansion of a leading German training aircraft manufacturer, through the financing of four training aircraft for its pilot academy in September 2022.

Thanks to its level of sophistication, the aircraft is the perfect fit to train specialized pilots who are becoming essential in a world where natural disasters will be more and more present.

LHI Group, one of the leading German asset managers specialized in aviation, renewables and real estate, originated and structured the deal in partnership with Flexam.

It is the first transaction in the aviation sector, in which FLEXAM TAIF II intends to further develop targeting specialized assets with a social purpose.

FLEXAM TAIF II has supported the expansion of a leading German training aircraft manufacturer, through the financing of four training aircraft for its pilot academy in September 2022.

Thanks to its level of sophistication, the aircraft is the perfect fit to train specialized pilots who are becoming essential in a world where natural disasters will be more and more present.

LHI Group, one of the leading German asset managers specialized in aviation, renewables and real estate, originated and structured the deal in partnership with Flexam.

It is the first transaction in the aviation sector, in which FLEXAM TAIF II intends to further develop targeting specialized assets with a social purpose.

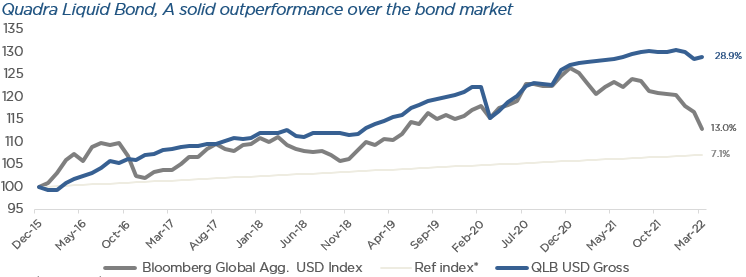

Quadra Capital Partners is pleased to welcome back Sebastien Gangnat-Tunzini as Executive Director. In his new Montreal based role, Sebastien will manage the Quadra Liquid Bond Fund launched in Canada in April 2021, as well as liaise and develop client relationship in Canada. He will also implement new business strategies in Canada and Europe for Quadra Capital’s investors.

“I am delighted to welcome Sebastien back to Quadra. His Portfolio management skills, CFA Qualifications and strong knowledge of our firm will be a tremendous asset to our Company”,said Guillaume Touze, Founder and Managing Partner of Quadra Capital.

With more than 10 years of experience in asset management, Sebastien’s market knowledge and products’ development skills will be welcome and will contribute in the expansion of Quadra strategies for the benefit of our investors.

“I am very pleased to join a dynamic team and look forward to contributing to the development of Quadra Capital in Canada, which offer very attractive alternative strategies to investors.” said Sebastien.

Quadra Capital Partners is pleased to welcome back Sebastien Gangnat-Tunzini as Executive Director. In his new Montreal based role, Sebastien will manage the Quadra Liquid Bond Fund launched in Canada in April 2021, as well as liaise and develop client relationship in Canada. He will also implement new business strategies in Canada and Europe for Quadra Capital’s investors.

“I am delighted to welcome Sebastien back to Quadra. His Portfolio management skills, CFA Qualifications and strong knowledge of our firm will be a tremendous asset to our Company”,said Guillaume Touze, Founder and Managing Partner of Quadra Capital.

With more than 10 years of experience in asset management, Sebastien’s market knowledge and products’ development skills will be welcome and will contribute in the expansion of Quadra strategies for the benefit of our investors.

“I am very pleased to join a dynamic team and look forward to contributing to the development of Quadra Capital in Canada, which offer very attractive alternative strategies to investors.” said Sebastien.