REMAIN CAUTIOUS AND DIVERSIFY IN ALTERNATIVES STRATEGIES

H1 2022 correction on liquid assets continued in Q3. The early summer rebound proved to be a tactical one and both equities and rates ended the quarter below their end of June level. Stress factors are well documented and should persist in the coming weeks. We recommend to maintain a cautious bias at least until Central Banks get nearer to the end of their monetary tightening phase.

The 2022 scenario confirms the relevance of fund selection and diversification into alternative asset classes. Our belief is that the current volatility will provide good entry points to performing liquid strategies. In our opinion, it also justifies increasing allocation into diversifying alternative assets.

In this newsletter, we are drawing your attention to Flexam and Quadra Liquid Bond, two strategies particularly relevant in the current context. In a complicated environment, we congratulate them for their performance and resilience.

FLEXAM & QUADRA LIQUID BOND : WHY IT MAKES SENSE NOW

FLEXAM : Flexam’s second fund is very relevant in the current turmoil. Tailor-made real assets financing also offers investors a secure capital base and long-term visibility on cash flow generation. Focused on four key thematics (mobility, logistics, energy transition, light infrastructure & equipment), Flexam reduces portfolio risk exposure while offering secures returns (10%+ generated on the new fund’s investments) and offers a remarkable liquidity for this type of asset.

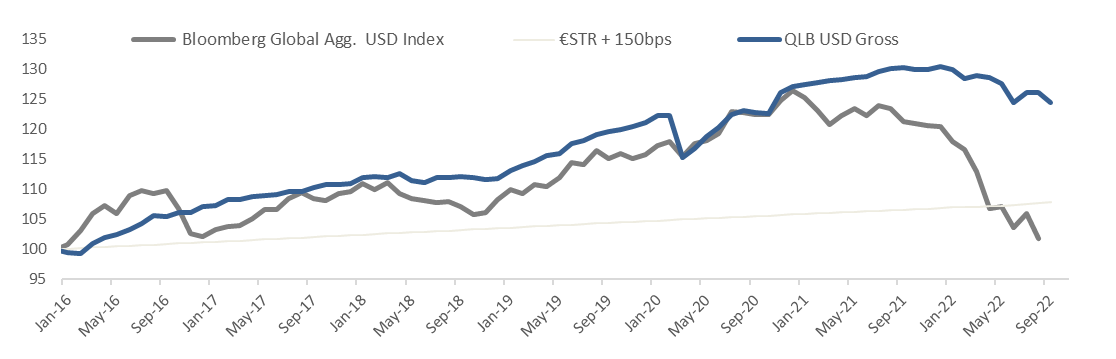

QUADRA LIQUID BOND : Despite turbulent macro-economic environment since its launch, our fixed income solution launched in Canada has demonstrated its risk management and volatility control qualities this year with a significant outperformance vs Bloomberg Global Aggregate (+14% as of end of September). In Q3 2022, the gross performance has even been positive. Due to our diversified asset allocation, the fund generates alpha and offers defensive characteristics in times of uncertain economic and rates cycles.

QUADRA LIQUID BOND, SOLID OUTPERFORMANCE OVER THE BOND MARKET

Source Apex / Quadra Capital Partners / Bloomberg. As at 30/09/2022. Blend simulated performance calculated with the allocation as of 31/12/2021. Live performance since April 2021. Past performance is not a reliable indicator of future results and investors may not get back amount originally invested. Ref index; €STR + 150bps.

Source Apex / Quadra Capital Partners / Bloomberg. As at 30/09/2022. Blend simulated performance calculated with the allocation as of 31/12/2021. Live performance since April 2021. Past performance is not a reliable indicator of future results and investors may not get back amount originally invested. Ref index; €STR + 150bps.

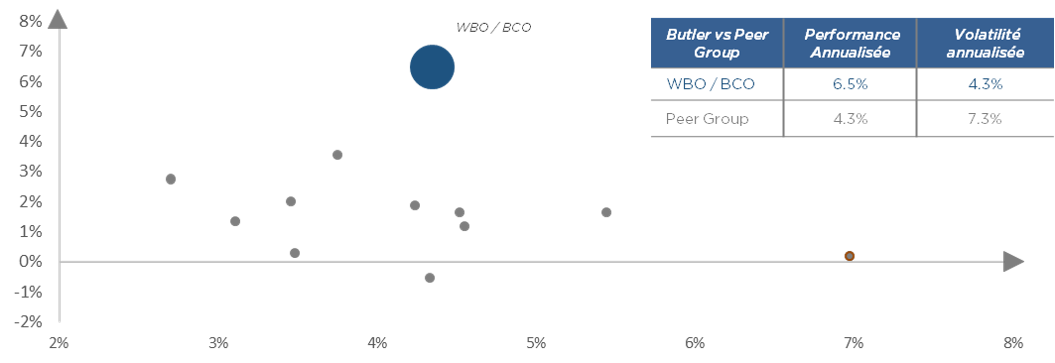

BUTLER CREDIT OPPORTUNITIES, A KEY CONTRIBUTOR TO THE QUADRA LIQUID BOND

Source Butler Investment Manafers and Bloomberg as of 30/09/2022. The performance of WBO/BCO os represented by the USD A2 share class of the WBO fund since inception on the 01/10/2009 till 31/05/2017, then by the EUR Institutional Founder (ISIN; IE00BMVX1R57) of the BCO fund from 01/06/2017 till as of date. BCO Investments present a risk of loss of capital and their liquidity may be limited. Income is not garanteed and depends on the evolution of te financial markets and/or exchange rates. These performance figures to the past and past performance is not a reliable guide to the future performance. Since WBO inception 01/10/2009.

FLEXAM: NINTH AND LATEST INVESTMENT OF THE FUND FTAIF II

FLEXAM TAIF II has supported the expansion of a leading German training aircraft manufacturer, through the financing of four training aircraft for its pilot academy in September 2022.

Thanks to its level of sophistication, the aircraft is the perfect fit to train specialized pilots who are becoming essential in a world where natural disasters will be more and more present.

LHI Group, one of the leading German asset managers specialized in aviation, renewables and real estate, originated and structured the deal in partnership with Flexam.

It is the first transaction in the aviation sector, in which FLEXAM TAIF II intends to further develop targeting specialized assets with a social purpose.

DISCLAIMER

Quadra Capital Partners LLP is registered in England and Wales and is authorised and regulated by the Financial Conduct Authority. In accordance with the SYSC 10A rule of the FCA handbook calls will be recorded. Copyright material and/or confidential and/or privileged information may be contained in this e-mail and any attached documents. The material and information is intended for the use of the intended addressee only. If you are not the intended addressee, or the person responsible for delivering it to the intended addressee, you may not copy, disclose, distribute, disseminate or deliver it to anyone else or use it in any unauthorised manner or take or omit to take any action in reliance on it. To do so is prohibited and may be unlawful. The views expressed in this e-mail may not be those of the Company from which it has come but the personal views of the originator. If you receive this e-mail in error, please advise the sender immediately by using the reply facility in your e-mail software. Please also delete this e-mail and all documents attached immediately.

Quadra Capital Partners France has a non-independent consulting activity. Thus, it may receive retrocession from the funds managers that Quadra selected for its customers. These retrocessions do not affect its analysis of these funds’ features and its ability to report on them, the strengths as the risks, in a full transparency to its clients and in their best interest.

Quadra Capital Partners LLP is registered in England and Wales and is authorised and regulated by the Financial Conduct Authority. In accordance with the SYSC 10A rule of the FCA handbook calls will be recorded. Copyright material and/or confidential and/or privileged information may be contained in this e-mail and any attached documents. The material and information is intended for the use of the intended addressee only. If you are not the intended addressee, or the person responsible for delivering it to the intended addressee, you may not copy, disclose, distribute, disseminate or deliver it to anyone else or use it in any unauthorised manner or take or omit to take any action in reliance on it. To do so is prohibited and may be unlawful. The views expressed in this e-mail may not be those of the Company from which it has come but the personal views of the originator. If you receive this e-mail in error, please advise the sender immediately by using the reply facility in your e-mail software. Please also delete this e-mail and all documents attached immediately.

Quadra Capital Partners France has a non-independent consulting activity. Thus, it may receive retrocession from the funds managers that Quadra selected for its customers. These retrocessions do not affect its analysis of these funds’ features and its ability to report on them, the strengths as the risks, in a full transparency to its clients and in their best interest.

Additional Information for Canadian Investors

An investment in the shares of the fund mentioned in this document is only available to an investor who is: (a) an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions who is subscribing to the shares of the fund mentioned in this document and any subsequent shares as principal for its own account and not for the benefit of any other person; and (b) a “permitted client” within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Securities legislation in certain provinces or territories of Canada may provide an investor with remedies for rescission or damages if this document contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the investor within the time limit prescribed by the securities legislation of the investor’s province or territory. The investor should refer to any applicable provisions of the securities legislation of the investor’s province or territory for particulars of these rights or consult with a legal advisor.

Quadra Capital Partners LLP is registered in England and Wales and is authorised and regulated by the Financial Conduct Authority.

Quadra Capital Partners LLP is registered in England and Wales and is authorised and regulated by the Financial Conduct Authority.